More data

Latency reduction

Fewer fraud

Less abandonment

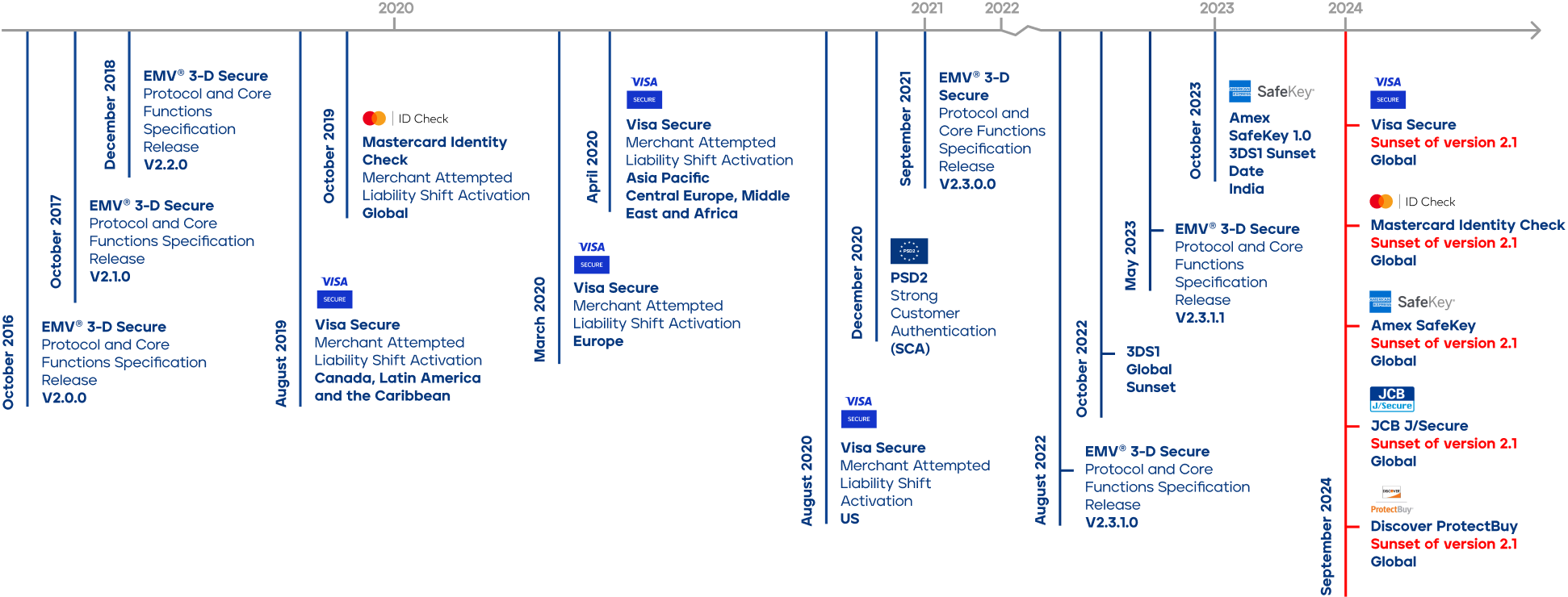

The Revised Payment Service Directive (PSD2) in EU was introduced to promote new types of payment services, and enhance customer protection and security. PSD2 has set out deadlines for businesses to comply with its regulations.

*The dates in this timeline are received directly from the card schemes. GPayments recognises that these dates are subject to change due to external circumstances.

Businesses that operate within the European Union will soon have to comply with SCA regulation changes that can have a significant impact on how business is conducted. SCA promotes the use of two-factor authentication and implementing 3DS2 is commonly agreed to be the best method to comply with SCA.

Learn more about comply with SCA under PSD2

Multi issuer support

HSM agnostic

User friendly web based administration

Extensive reporting and customer management

User friendly web based administration

Multi issuer support

Extensive reporting and customer management

Effortless implementation

Compliant with all major card schemes

Cloud deployment ready

EMVCo certified

Effortless customer experience

Right out of the box deployment in your own environment

Interoperability with 3DS1 protocol

Compliant with all major card schemes

Native mobile support

Available for both Android and iOS

Complete ActiveServer integration by default

TestLabs can be used to test any

3D Secure component, or to perform compliance testing prior to Product Integration Testing.

Unlike many test tools that utilise simulators, TestLabs comprises live and fully developed 3DS2 components: ActiveServer (a 3DS Server), a 3DS2 Access Control Server and a Directory Server.

Suitable for regional card brand 3DS implementations

EMVCo certified

High performance and multi-tenanted to support multiple issuers and acquirers