Leading the way as a global provider in Card-Not-Present 3D Secure processed transactions for card issuers, payments processors and fintech solution providers.

Protect your cardholders and increase transaction volume, revenue, and user experience with ActiveAccess. Build trust, loyalty, and satisfaction through a secure shopping experience. Discover the power of ActiveAccess, the robust and market-leading Access

Control Server (ACS) platform designed to provide unparalleled cardholder authentication for card issuers. Elevate your business with ActiveAccess now.

Boost sales, build customer trust, and protect your business by minimising risk and offering a secure and effortless shopping experience.

Delivering smooth cross-industry and cross-border coverage with seamless interoperability, enabling global reach and efficient business connectivity.

Utilise various parameters in the ACS to ensure a thorough assessment of transaction risk, improving the security of digital payments.

Gain a competitive edge through unmatched agility, enabling rapid adaptation to changes, by forming a partnership with GPayments unlike any other.

Secure customer transactions and prevent fraud and chargebacks through advanced authentication and real-time fraud detection techniques.

ActiveAccess Service places a strong emphasis on security and compliance to ensure your adherence to payment industry security and compliance regulations.

Stay ahead of the competition by scaling and expanding seamlessly with international and domestic card scheme support.

Experience unrivalled sales and support assistance thanks to a single point of contact, for all enquiries, and proactive resolution of your queries.

Take advantage of the best of both worlds: store cardholder information locally in the ACS or integrate with current card management systems for flexible remote authentication.

Flexible adapter-based interface for issuer risk rules and seamless integration with third-party RBA solutions. Communicate with third-party OOB services for

enhanced authentication options.

Effortlessly manage multiple issuers and independent entities with custom configurations, branding, or cohesive groups to streamline operations.

Efficiently interact with third-party authentication services beyond the 3D secure flow, enabling cardholders to authenticate offline for a period of 7 days.

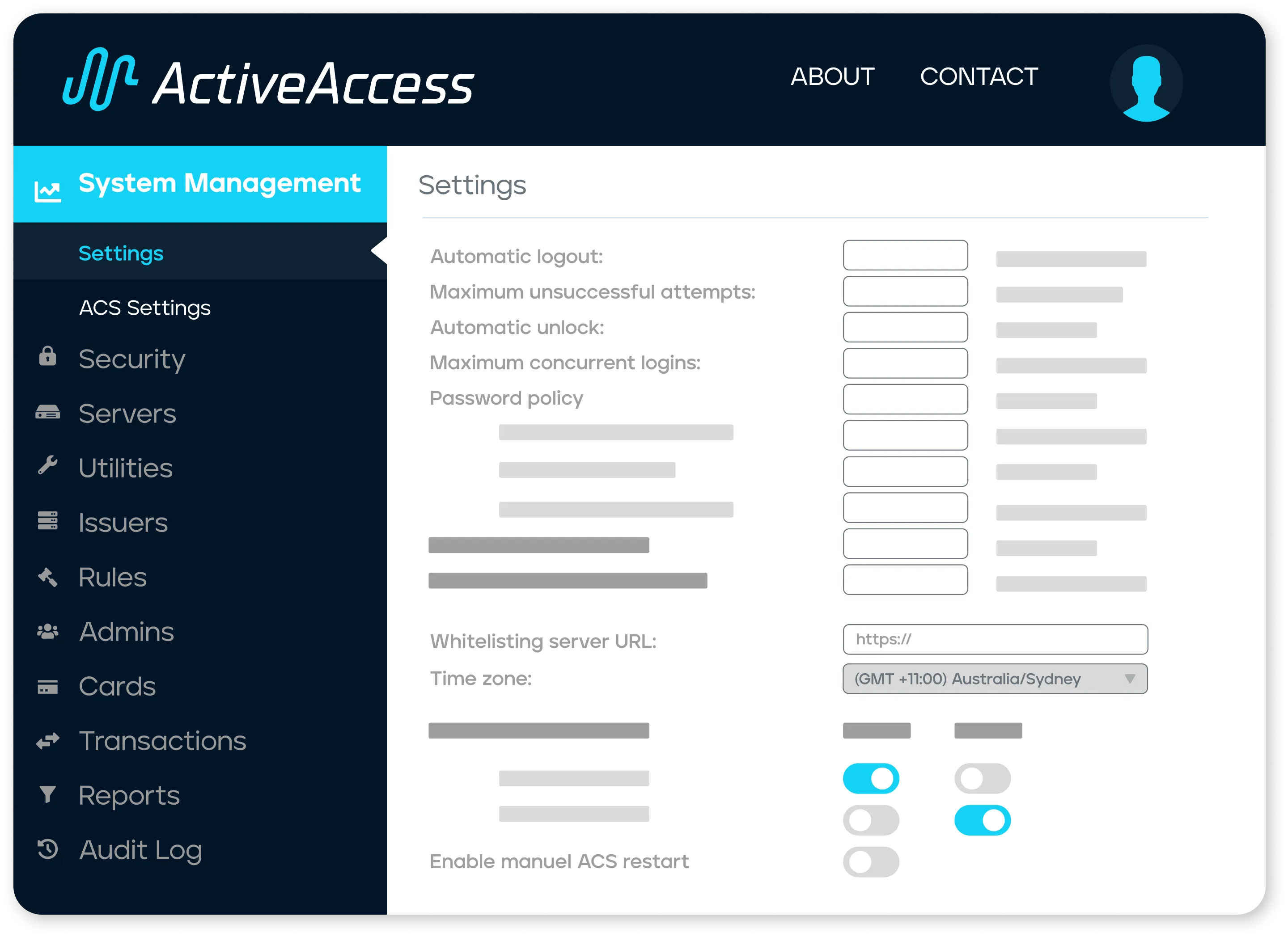

The whitelisting API supports the creation of whitelists of trusted merchants, allowing for authentication bypassing. The ActiveAccess administration console enables issuers to view and manage the whitelist.

Enjoy peace of mind with an advanced solution that fully embraces the Strong Customer Authentication (SCA) requirements of PSD2. Protect your transactions with unique authentication codes while empowering payers with real-time payment information.

ActiveServer implements a 3DS2 enrolment check API to enable backwards compatibility with your 3DS1 systems. ActiveServer caches the BIN ranges of cards that are enrolled in 3D Secure 2. Before each authentication, the API call can be made to determine whether the given card supports 3D Secure 2. If not, you may fall back to an existing 3D Secure 1 MPI implementation. This API ensures compatibility with any 3D Secure 1 MPI on the market, and is crucial for merchants to obtain liability shift on 3D Secure 1 before liability shift for 3D Secure 2 is activated, or to adhere to regional mandates.

Enterprise-level hosted solution for fraud prevention, with secure multi-tenancy ActiveServer cluster, hosted on a world-leading cloud provider.

Hosted solution with control and customisation options. Clients can delegate service maintenance or self-manage.

Easy installation, on-premise deployment, high-availability cluster configuration, and customisable administration options.

Experience a secure, bank-grade hosted solution, featuring a multi-tenancy ActiveAccess cluster hosted on a globally renowned cloud provider.

Benefit from a hosted solution that offers control and customisation options. You have the flexibility to delegate service maintenance or choose to self-manage according to your preferences.

ActiveAccess is easy to install for on-premise deployments with high-availability cluster configuration and customisable administration options.

Please feel free to reach out to us if you have any enquiries. Our team is readily available to assist you and will provide prompt responses to your questions.