3D Secure is an XML-based protocol, designed by Visa, that adds an additional security layer for online credit card transactions. The service is offered to customers as Visa Secure. This protocol has also been adopted by Mastercard, JCB, American Express and Diners Club International with the services named SecureCode, J/Secure, SafeKey and ProtectBuy, respectively.

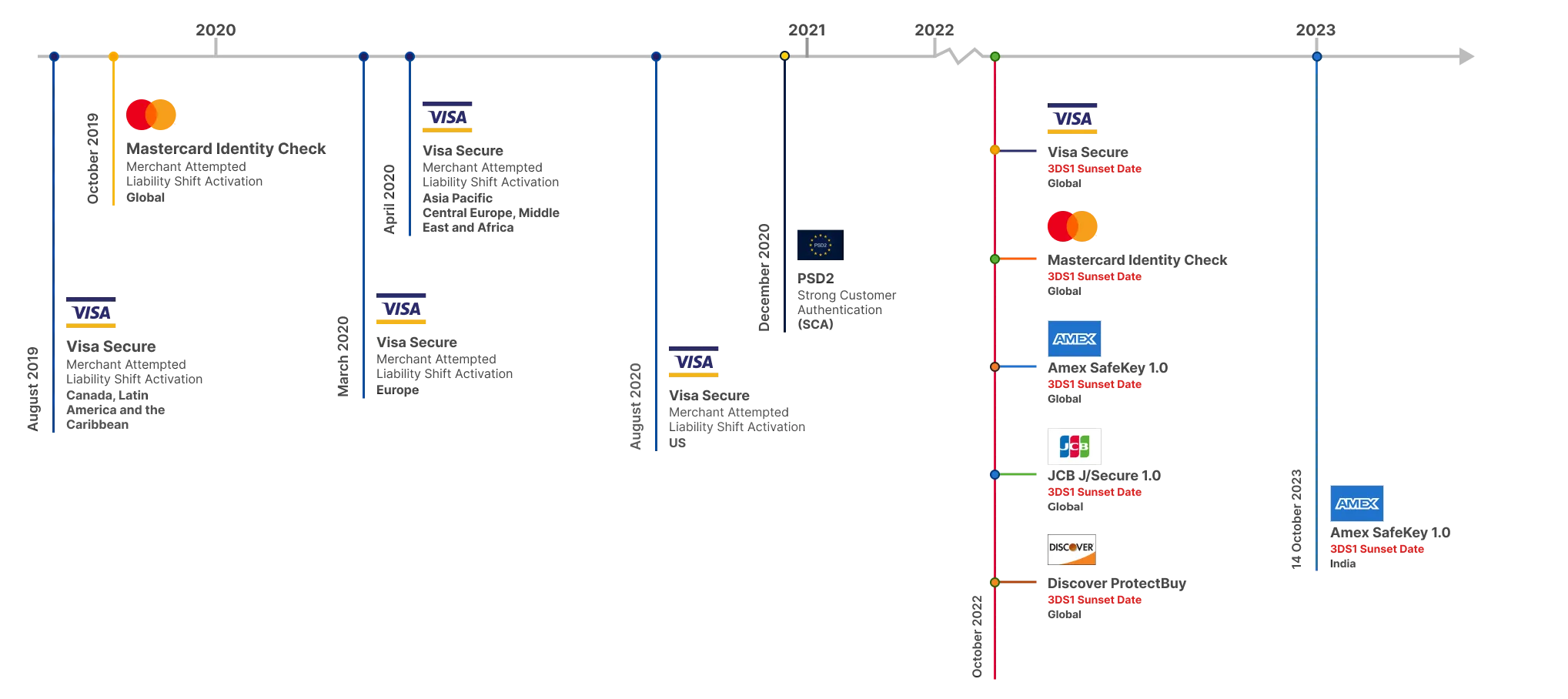

3D Secure is an authentication protocol for online credit card payments, and it has been the de facto authentication standard since the year 2000. A recent revision to the protocol has produced "3D Secure 2”, which includes many added features and benefits over 3DS1. But while the industry is gradually transitioning from 3DS1 towards its successor, 3DS1 still remains the most widely adopted authentication protocol for eCommerce transactions. 3D Secure was designed by Visa in 1999, and has since been adopted by other card schemes. You may have used 3D Secure before when asked to type in a password during eCommerce checkout, or you may recognise the protocol by its various market branded names.

3DS1 has been widely deployed in all countries around the world, and has a long, proven record of solving credit card fraud issues for merchants, payment gateways, and banks alike.

*The dates in this timeline are received directly from the card schemes. GPayments recognises that these dates are subject to change due to external circumstances.

As specialists in 3D Secure, we developed all components of the 3D Secure ecosystem. Whether you're a merchant in the Canada, an issuing bank in Italy, or a regional card scheme in South East Asia looking for a Directory Server, we have the right solution to help you with all your 3D Secure needs.

Cloud deployment ready

EMVCo certified

Effortless customer experience

Right out of the box deployment in your own environment

Interoperability with 3DS1 Protocol

Right out of the box deployment in your own environment

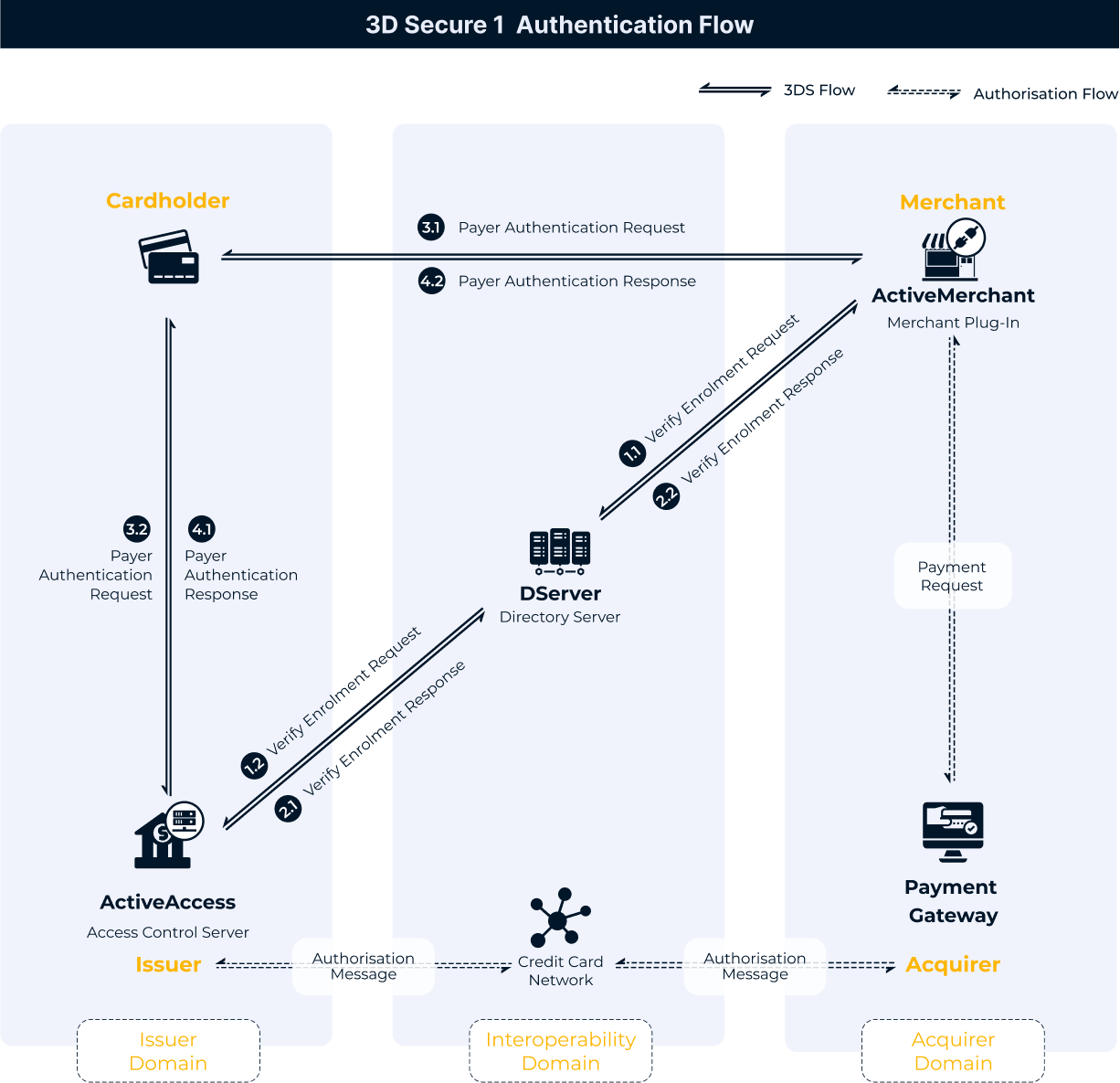

Our MPI, aptly named "ActiveMerchant", provides acquiring side cardholder authentication. ActiveMerchant is a very stable and mature product with easy installation, a standard API based integration, and an intuitive user interface. ActiveMerchant has been tried, tested, and proven by online merchants, payment gateways, acquiring banks from all 5 continents of the globe.

ActiveAccess is our ACS solution, and has been deployed by issuing banks, enterprises, government, and other application service providers from all around the world. ActiveAccess provides 3D Secure eCommerce transaction authentication, as well as multi-factor user authentication. ActiveAccess also can process both 3DS1 and 3DS2 transactions, which means clients can easily support both protocols during the transition period.

Native mobile Support

Available for both Android and IOS

Complete ActiveServer integration by default